do nonprofits pay taxes on rental income

Expenses of renting property can be deducted from your gross rental income. If youre facing a.

Pin By Letter Writing Tips On Fundraising Letters Business Letter Sample Fundraising Letter Guided Writing

Losing Your Home for Failure to Pay Property Taxes.

. Your brother would list his 40 share of the income and deductions from the co-owned rental house on his Schedule E and pay tax on that amount. You would list the other 60 on your own Schedule E. You generally deduct your rental expenses in the year you pay them.

If one co-tenant pays more than his or her proportionate share of the expenses the overpayment is treated as a loan to the other co-tenants and may. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E. If you fail to reimburse the mortgage lender it might foreclose your home.

If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. When you dont pay your property taxes the taxing authority could sell your homeor its lien on the propertyto satisfy your debt. Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment if you rent part of your property or if you change your property to rental use.

Or your mortgage lender might pay the taxes and then bill you.

Converting A For Profit Into A Nonprofit Nonprofit Law Blog

The Most And Least Expensive U S States To Rent A Home Vivid Maps Apartment Cost Low Income Housing Rent

New Study Of Nonprofit Financial Literacy Misses The Mark Investing Marketing Analytics Best Way To Invest

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping Chart Of Accounts Accounting Downloadable Resume Template

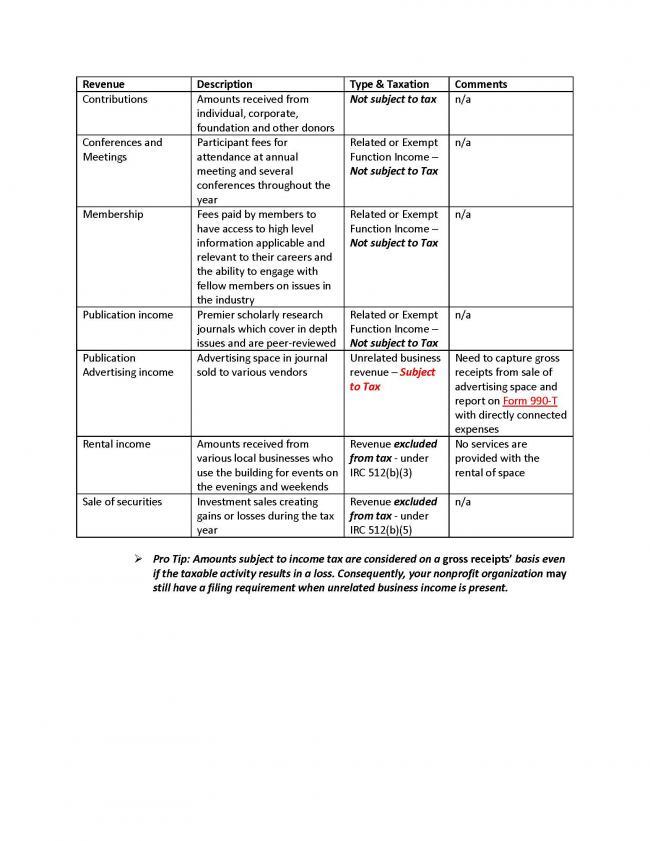

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Free Cash Flow Forecast Templates Smartsheet Cash Flow Personal Finance Budget Templates

2020 Guidelines For A Nonprofit Reimbursement Policy

Every Nonprofit S Tax Guide How To Keep Your Tax Exempt St Tax Guide Non Profit Irs

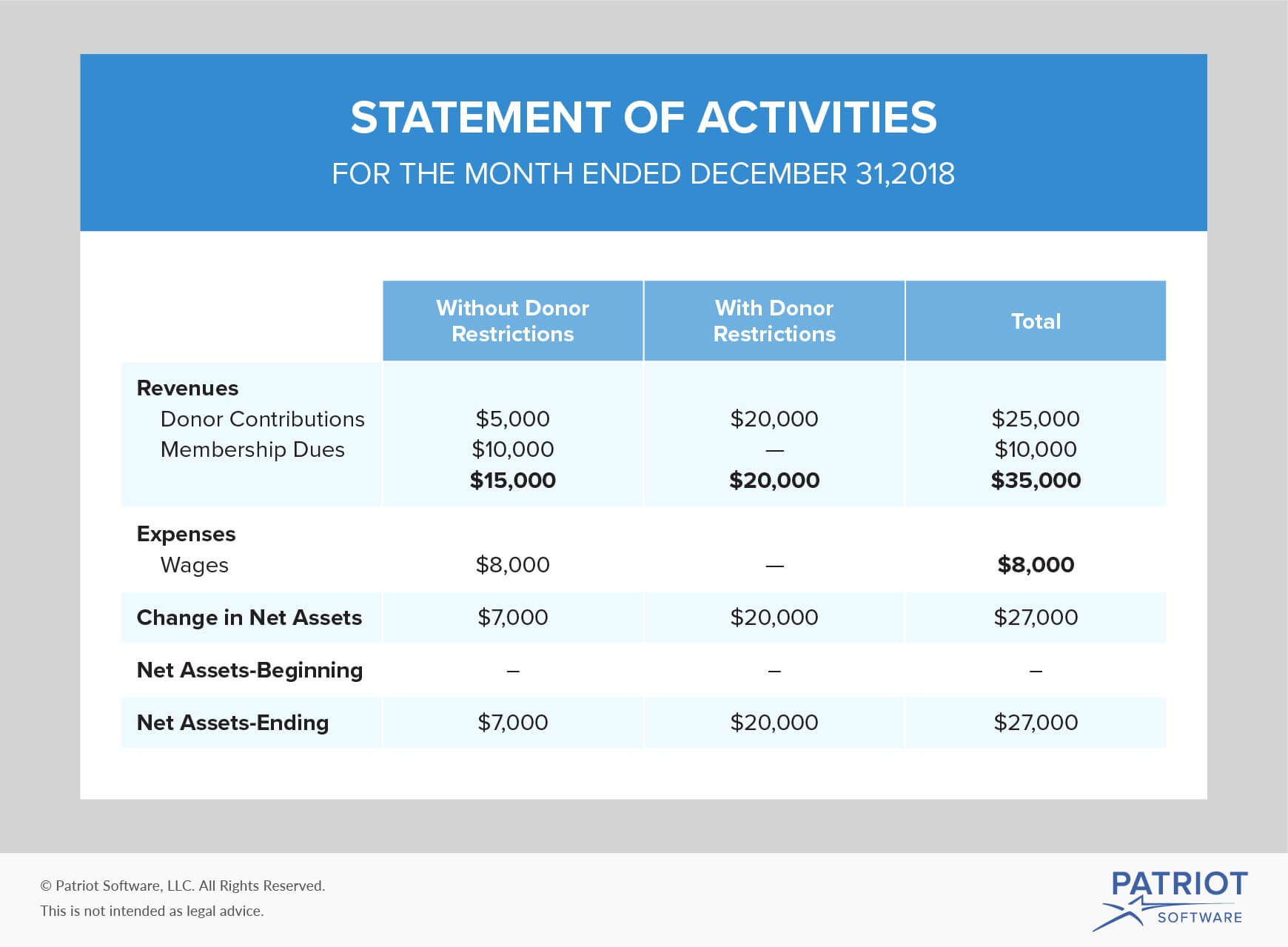

Accounting For Nonprofit Organizations Financial Statements Beyond

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

How Gst Affects Nonprofits India Development Review

Pdf Taxation Of Non Profit Associations In An International Comparison

How To Raise Large Funds For A Non Profit Organization Non Profit Nonprofit Organization Nonprofit Fundraising

How To Set Up A Chart Of Accounts In Quickbooks Qbalance Com Chart Of Accounts Quickbooks Accounting

Fundraising Development Plan Template Fresh Fundraising For Non Profits William Paterson Non Fundraising Event Planning Donation Letter Business Plan Template

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)